Maximize Conversions, Minimize Delays

Maximize Conversions, Minimize Delays

Trust Requires Speed

Fast financial platforms build customer confidence

Fast financial platforms build customer confidence

"Fast financial platforms build customer confidence

Financial Services Segmentation Challenges

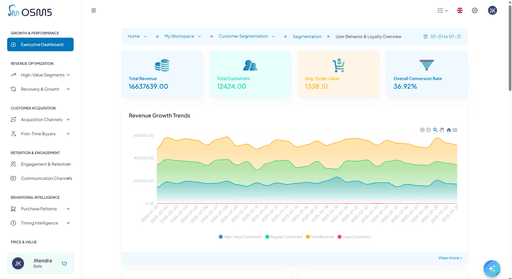

Deliver personalized experiences, campaigns, and communications to banking, fintech, and investment customers. Improve engagement, reduce churn, and drive revenue with behavior-driven segmentation.

Financial services organizations often struggle to identify high-value clients, segment by risk or product interest, and deliver timely, relevant campaigns. Generic campaigns lead to low engagement, missed upsell opportunities, and reduced retention. Without proper segmentation, teams cannot optimize cross-selling, product adoption, or customer communications effectively.

Common Problems Customer Segmentation Uncovers:

Low engagement with financial products or services

High churn of valuable clients

Missed opportunities for cross-sell or upsell

Wasted marketing spend on low-intent segments

Difficulty identifying high-risk or high-value customers

Business Impact Assessment with Customer Segmentation:

Customer Segmentation transforms customer behavior and product usage data into actionable segments, enabling targeted campaigns, improved retention, and optimized revenue opportunities.

Key Metrics:

Increase product engagement by 20–30%

Reactivate up to 35–40% of dormant customers

Improve cross-sell/upsell conversions by 15–25%

Reduce wasted campaign spend by up to 50%

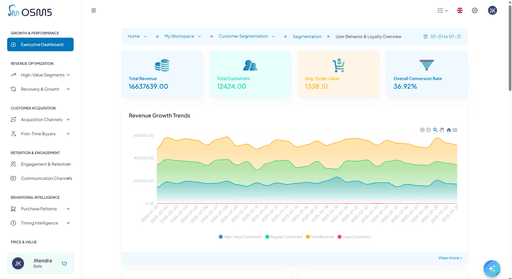

Financial services organizations often struggle to identify high-value clients, segment by risk or product interest, and deliver timely, relevant campaigns. Generic campaigns lead to low engagement, missed upsell opportunities, and reduced retention. Without proper segmentation, teams cannot optimize cross-selling, product adoption, or customer communications effectively.

Common Problems Customer Segmentation Uncovers:

Low engagement with financial products or services

High churn of valuable clients

Missed opportunities for cross-sell or upsell

Wasted marketing spend on low-intent segments

Difficulty identifying high-risk or high-value customers

Business Impact Assessment with Customer Segmentation:

Customer Segmentation transforms customer behavior and product usage data into actionable segments, enabling targeted campaigns, improved retention, and optimized revenue opportunities.

Key Metrics:

Increase product engagement by 20–30%

Reactivate up to 35–40% of dormant customers

Improve cross-sell/upsell conversions by 15–25%

Reduce wasted campaign spend by up to 50%

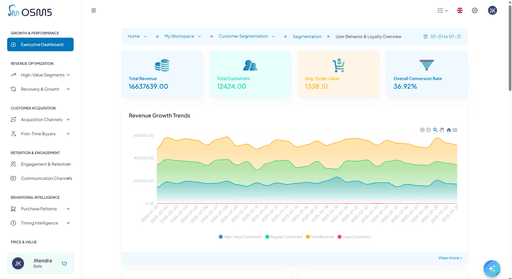

Financial services organizations often struggle to identify high-value clients, segment by risk or product interest, and deliver timely, relevant campaigns. Generic campaigns lead to low engagement, missed upsell opportunities, and reduced retention. Without proper segmentation, teams cannot optimize cross-selling, product adoption, or customer communications effectively.

Common Problems Customer Segmentation Uncovers:

Low engagement with financial products or services

High churn of valuable clients

Missed opportunities for cross-sell or upsell

Wasted marketing spend on low-intent segments

Difficulty identifying high-risk or high-value customers

Business Impact Assessment with Customer Segmentation:

Customer Segmentation transforms customer behavior and product usage data into actionable segments, enabling targeted campaigns, improved retention, and optimized revenue opportunities.

Key Metrics:

Increase product engagement by 20–30%

Reactivate up to 35–40% of dormant customers

Improve cross-sell/upsell conversions by 15–25%

Reduce wasted campaign spend by up to 50%

Analytics without the guilt.

Analytics without the guilt.

Analytics without the guilt.

Usecases

Explore Customer Segmentation’s powerful features, including behavioral tracking, user engagement analysis, dynamic audience segmentation, and personalized campaign targeting – all privacy-first and easy to implement.

How It Works

How It Works

How It Works

Privacy-First by Design. Compliance Made Simple.

Privacy-First by Design. Compliance Made Simple.

Track user behavior while respecting privacy. Meet global compliance standards without slowing down your growth.

Built with team logic

Built with team logic

Built with team logic

Adapts as work evolves

Adapts as work evolves

Adapts as work evolves

Insights without setup

Insights without setup

Insights without setup

Integration and Compatibility

Seamless Implementation

Set up tracking in minutes with a single code snippet that automatically monitors every page across your site. Works seamlessly with any platform or framework and supports dynamic webhook integration.

Under 5KB compressed JS footprint

Async loading with 0 render blocking

Compatible with all major frameworks and CMSs

Instant data collection and reporting

Integration and Compatibility

Seamless Implementation

Set up tracking in minutes with a single code snippet that automatically monitors every page across your site. Works seamlessly with any platform or framework and supports dynamic webhook integration.

Under 5KB compressed JS footprint

Async loading with 0 render blocking

Compatible with all major frameworks and CMSs

Instant data collection and reporting

Integration and Compatibility

Seamless Implementation

Set up tracking in minutes with a single code snippet that automatically monitors every page across your site. Works seamlessly with any platform or framework and supports dynamic webhook integration.

Under 5KB compressed JS footprint

Async loading with 0 render blocking

Compatible with all major frameworks and CMSs

Instant data collection and reporting

Ready to Make Smarter Business Decisions?

Join thousands of organizations using RageEdge to grow their business while building user trust. Start your free trial today—no credit card required, full features included, and setup support provided.

Ready to Make Smarter Business Decisions?

Join thousands of organizations using RageEdge to grow their business while building user trust. Start your free trial today—no credit card required, full features included, and setup support provided.

Ready to Make Smarter Business Decisions?

Join thousands of organizations using RageEdge to grow their business while building user trust. Start your free trial today—no credit card required, full features included, and setup support provided.